The announcement that Carlos Brito, the CEO of Anheuser-Busch InBev (AB InBev), will be stepping down from the company on July 1st after 32 years, including the last 15 years at the helm, was backdropped by a robust set of Q1 numbers. Brito highlighted total volume numbers up 13.3% and total revenue numbers up 17.2% on his final earnings call. Their earnings per share also increased from $.51 to $.55. The company delivered beer volume growth of up 2.8% compared to numbers from Q1 in 2019, showing that their growth trend is not solely related to COVID-19 related disruptions.

The main message of the call was the ability of the company to deliver growth due to their focus on premiumization and the phenomenal growth of a new segment they have been calling Beyond Beer.

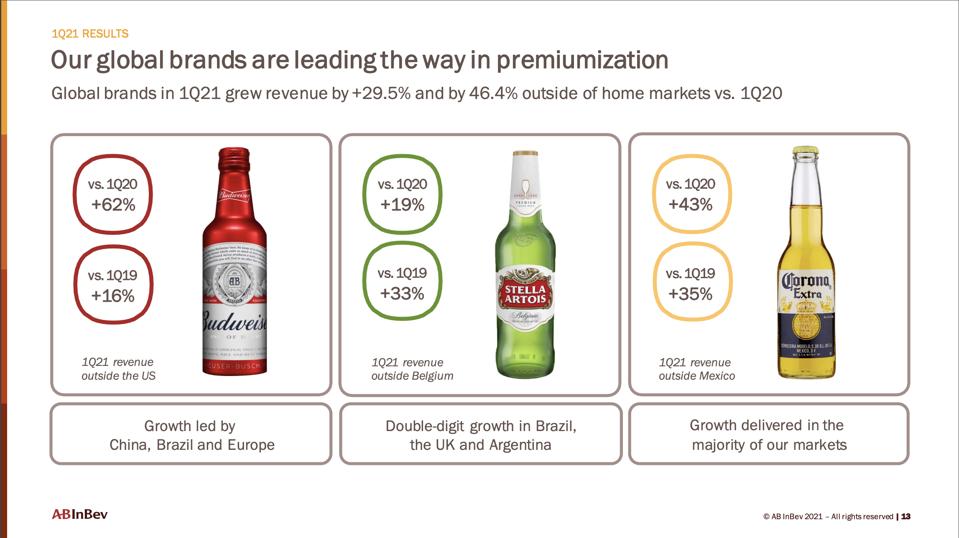

Over the last decade, the company has expanded its premium offerings by buying up craft breweries, solidifying its control of Corona outside the United States, expanding markets, and launching new brands. That has resulted in their premium segment accounting for 30% of their total revenue, up from 24% in 2017. By focusing on premium brands and their higher profit margins, they grew revenue in that segment by 28% for the quarter. The company said that it plans to continue to focus on growth in this segment and foresees its investments in their B2B platform BEES, and their owned e-commerce business, which quadrupled in Q1, only helping fuel momentum.

AB InBev saw strong growth from its three leading premium brands Budweiser, Stella Artois, and … [+]

AB InBev

The other main focus of their presentation was on the explosive growth across the globe in alternative beverages like hard seltzers. According to Brito, there is a new category emerging in the alcohol industry, one existing in the blurry fringes between beer, spirits, and wine. They have named it Beyond Beer. It encompasses ready-to-drink beverages, hard seltzers, cider, and flavored malt beverages, with more products sure to enter in the future. As the largest beverage supply company globally, they sell one of every four beers consumed; AB InBev believes that they are ideally positioned to exploit the new segment. According to Brito, they expect the new category to grow to $58 billion overall by 2024. They will be a large part of it, building on their 40% growth in the area in Q1.

The company said that a new category they have named Beyond Beer has emerged in the alcohol space.

AB InBev

One of their plans is the worldwide rollout of Mike’s Hard Seltzers, a brand they own outside its United States home market. That’s on top of their successful launch of Michelob Hard Seltzer in Mexico, where its market share is over 45%. They also will be launching distribution partnership deals with Red Bull and Sazerac (Buffalo Trace, Fireball, Southern Comfort) in China this summer.

Their new CEO, Michel Doukeris, is inheriting a company that has no significant debt payments on the horizon for the next five years and a bond portfolio with 96% set at fixed rates. That should not inhibit his ability to continue to lead the company’s focus on expansion, innovation, and strategic growth. As a long-term AB InBev employee, he brings the lessons he learned running their Chinese and American markets to the helm. According to Brito, he is the right person to lead the company deeper into the digital age.