The White House is working to assure voters President Joe Biden is doing everything he can to lower the cost of living with just two weeks until Election Day as polls increasingly show the economy as a top concern for Americans.

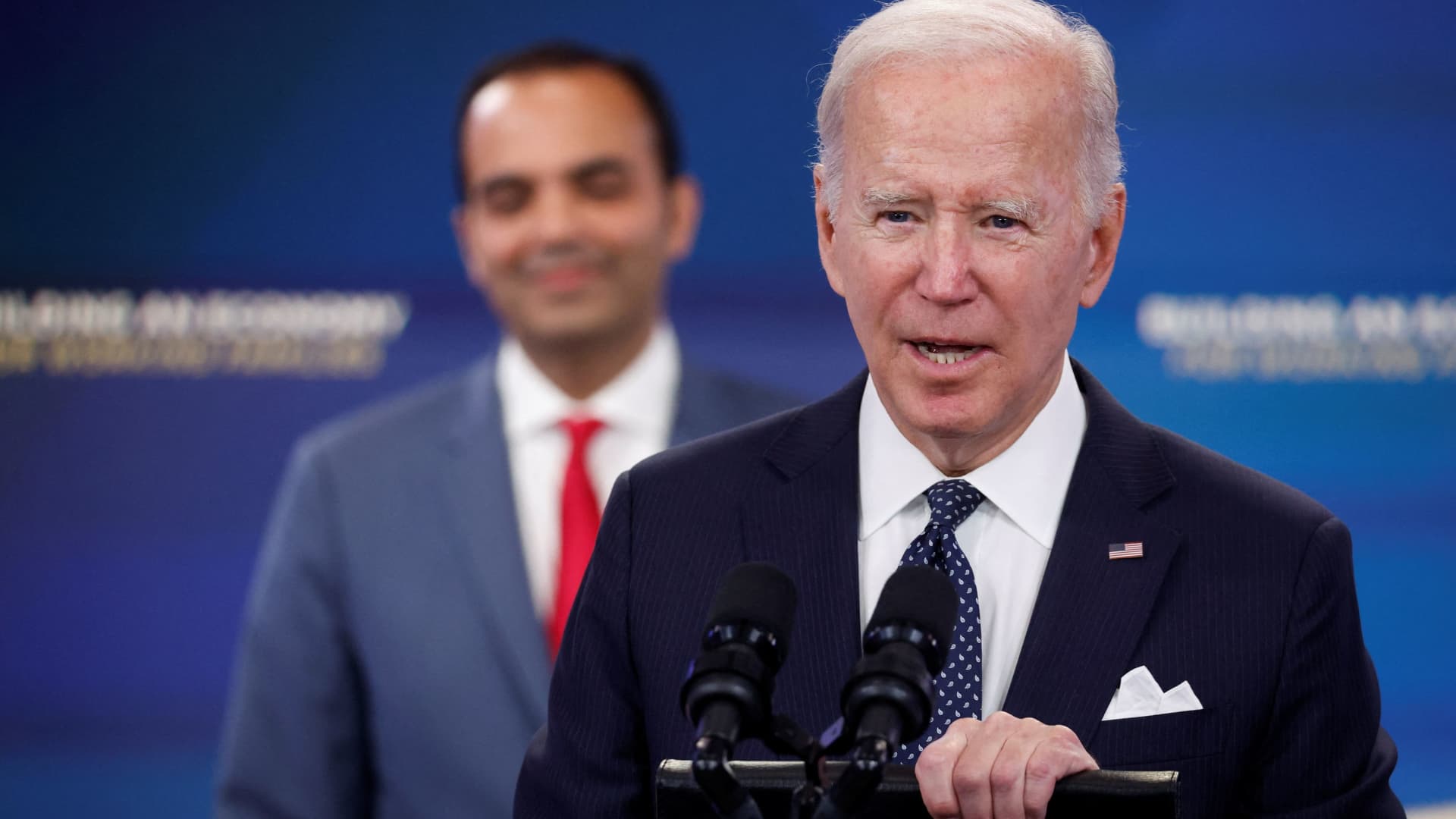

Flanked by CFPB Director Rohit Chopra and FTC Chair Lina Khan at the White House Wednesday, Biden announced initiatives to address “junk fees” from banks, airlines, cable companies and other industries. Junk fees are surprise costs added to consumer bills.

The speech was billed as “remarks on new actions to provide families with more breathing room.”

“One of the things that I think frustrates the American people is they know the world’s in a bit of a disarray,” Biden said Wednesday. “They know that Putin’s war has put an awful lot of strains on Europe and the rest of the world and the United States — everything from blocking grain shipments to oil. And they want to know: What are we doing? And there’s a lot going on that we’re doing. It adds up.”

Democrats are under pressure to show they are addressing inflation before the midterm elections on Nov. 8. In recent weeks voters increasingly rank the economy and inflation as their top concern in polls, outpacing the abortion issue and threats to democracy. Polls show voters tend to favor Republicans on economic issues.

A big talking point for Republicans is gas prices. Biden has been focused on lowering the price at the pump, frequently highlighting how the average price of gas in the United States has dropped from its peak of over $5 a gallon in June.

“We’re making serious progress in getting prices close to what they were before the pandemic,” Biden said. “I’m going to be working very hard to make sure that oil companies pass on the reduction in the price of a barrel of oil to the pump.”

The Biden administration’s latest initiative, reducing “junk fees,” has been months in the making as regulatory agency’s pressure or outright order companies to disclose or eliminate myriad fees, he said. For example, the Consumer Financial Protection Bureau rolled out new guidance Wednesday prohibiting banks from charging surprise overdraft fees on debit transactions and fees on deposits that later bounce.

“And we’re just getting started,” he said, adding that there are tens of billions of dollars in junk fees across industries that he’s directed his administration to reduce or eliminate. The Federal Trade Commission started work last week on cracking down “on unfair and deceptive fees across all industries — fees that were never disclosed … and there was no way to avoid the fee,” Biden said.

He cited processing fees for concert tickets, “resort fees” at hotels, “excessive” credit card late fees, airline booking fees and termination charges to keep consumers from switching cable or internet plans as some of the fees the administration is tackling.

These are “surprise charges the companies sneak in the bills because they can,” he said.

Airlines have added numerous fees over the past decade, such as preferred seating fees that don’t come with extra legroom. Major carriers have also introduced basic economy tickets, no frills fares that are less flexible than standard economy fares. The Biden administration’s proposal is already receiving pushback from carriers.

Delta Air Lines earlier this month said customers already have access to fees and prices and that it plans to file a formal comment on the proposal.

“They’re expecting a carrier to provide at moment of making the search every single potential fee or price without regard to who’s actually searching,” Peter Carter, Delta’s chief legal officer said on the Oct. 13 call. “So it may be a fee that’s not relevant to the consumer, which, of course, could create quite a bit of confusion for consumers.”

Chopra, who spoke at the press conference, said bank overdraft and bounced check fees were “likely unfair and unlawful.” Biden said the move would “immediately start saving Americans collectively billions of dollars in unfair fees” and hold corporations accountable.

“My administration is also making it clear surprise overdraft fees are illegal,” Biden said.

— CNBC reporters Sarah O’Brien and Leslie Josephs contributed to this story.