The last several years have seen an explosion of individuals and funds diving headlong into the world of spirits investing. Driven by the hyper explosion of the whisky market, where bottles of Scotch, Bourbon, and Japanese Whisky continually set new sales records, investors are actively searching out the next hot bottle.

This has led to numerous stories of individuals uncovering hidden gems or getting burned by counterfeits and fake investment platforms. It’s an exciting world many connoisseurs want into but don’t know how to enter safely.

A newly launched online trading platform, BAXUS, seeks to bring order to a chaotic environment. If things go the way they hope, they could become the digital global marketplace enthusiasts turn to when searching out rare spirits and wines. That would be a big win for drinkers and investors, especially those looking to build out their collections.

BAXUS is the brainchild of Tzvi Wiesel, a seasoned whisky investor and trader who launched his own whisky fund while studying computer and database learning at Columbia University. He teamed up with Carrie Carrington Kellar, a former New York Times

NYT

Left to right, Tzvi Wiesel, CEO and co-founder of BAXUS, Carrie Carrington Kellar, CTO and … [+]

“The god of wine and spirits is Baccus. So, BAXUS was born, which is the ‘tech-friendly’ version of the name,” said Wiesel. “At BAXUS, giving wines and spirits collectors and investors a place to participate in the market, when they otherwise wouldn’t have because of opaque pricing conditions, infrequent auctions, high fees, complicated legal framework around alcoholic beverages, and many other reasons is what drives us. BAXUS is solving these problems via a trusted third party responsible for custody and authentication, allowing institutions and individuals to digitally transact around the globe.”

Incorporating blockchain technology, AI learning, and data analysis, BAXUS is promising to level the playing field and provide its users with the most up-to-date pricing analysis. It all starts when a bottle arrives at their warehouse in New Jersey, where every bottle they deal with is stored in a climate-controlled environment. They control every bottle from the moment it enters the BAXUS ecosystem to ensure uniformity and protect consumers from scams. The burgeoning wine side of the platform is being offered in partnership with the French winemaker Maison Ginester, and all bottles listed are cellared at their estate in Bordeaux.

Each bottle is authenticated, 360-degree scanned, tagged with its own RFID label, and has its own unique non-fungible token (NFT

NFT

Once a bottle is listed for active sale, BAXUS will soon add a swapping and trading side to the platform; it goes live in the marketplace. Any member can reach out to the seller to buy the bottle there. Once it changes hand, it can either be shipped out or remain onsite, allowing collectors to create their own virtual cellars.

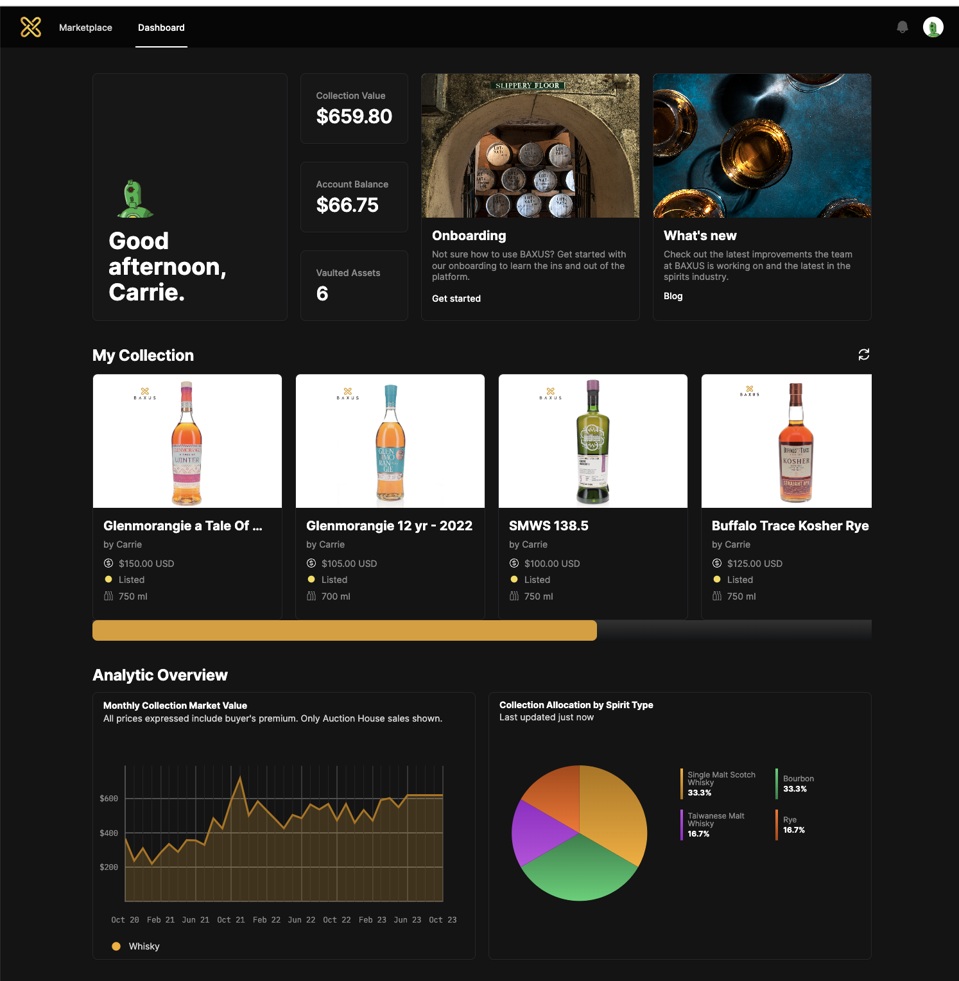

A dashboard screen shot with all of the data any owner has on BAXUS.

BAXUS has also teamed up with numerous distilleries worldwide. It has over 11,000 barrels of whiskies on its platform for investors to buy into. Each barrel also undergoes the same process as the bottles, with the only exception being that they are stored at their respective distilleries to age.

“We have spent the last two years establishing a two-sided marketplace that works for both buyers and sellers. The biggest part was ensuring that the authentication process was foolproof and making the platform easy for everyone,” says Wiesel. “By only working in real currency, not crypto, and creating a place to educate people on the whisky market, we are simplifying something that many want to partake in but don’t know how.”

Part of the allure of the platform is that there are no hidden fees to buyers. Instead, every bottle brought into its network is charged a $20 authentication fee. When a transaction happens, the seller pays a 10% fee. BAXUS is rolling out a lending feature to their site, too. That will allow owners to borrow against their bottles to expand their investment portfolio further.

The founders of BAXUS and their investors have high hopes that they have created a solution to a murky marketplace. Early beta results have been promising with over $20M in transactions, including many rarities like a 55-year-old Macallan for $155,000, a 72-year-old G&M Glen Grant for $90,000, and dozens of Pre-Prohibition bottles. Interest is high, and BAXUS had a waiting list of over 10,000 signed up to join the platform upon its opening on October 25, 2023.

There might finally be a simple solution for wine and spirits lovers who want to chase some luxury or rare bottles. That is good for the market and for the drinker.