Yesterday the Chicago-based operator of Foxtrot and Dom’s Kitchen & Market announced the closure of all store locations as they plan to file for bankruptcy. Part of the recently merged Outfox Hospitality group, Foxtrot has raised $194 million to date, according to Pitchbook. Investors include private equity firms Monogram Capital Partners and Lerer Hippeau, as well as Whole Foods co-founder Walter Robb and the celebrity chef David Chang.

The closure was first reported by industry expert Andrea Hernández in Snaxshot. It came as a surprise to vendors, employees, and customers. “I was just in Chicago on a sales call last Friday,” shared Dani Wong, the founder of Señor Mango. “They were a very important account for us, and the second retailer to carry our product.”

Chicago-based Outfox Hospitality, operator of Foxtrot and Dom’s Kitchen & Market, announced the … [+]

Foxtrot’s 33 stores were located in Chicago, Dallas, Austin, and Washington, D.C. Dom’s Market had two locations in Chicago.

“I was at Foxtrot in Dallas this last weekend. And I was supposed to leave for Austin this weekend to demo at their stores,” shared Kristin Charbo, founder and CEO of Glonuts. Based in Southern California, her brand had been carried in Foxtrot stores for the past two years and Foxtrot provided Glonuts significant distribution outside of the West Coast.

A Launching Pad For New Brands

Foxtrot was an important launching pad for emerging brands in an increasingly consolidated food retail landscape; according to the Federal Trade Commission, over 50% of food retail sales is concentrated at just eight national supermarket chains. For smaller brands, it is notoriously difficult and often prohibitively expensive to sell into stores and to stay on the shelf between production, distribution, sales and marketing costs.

Foxtrot had a different model, one that was centered around celebrating and promoting smaller brands. In a 2022 Forbes interview, Foxtrot co-founder Mike LaVitola shared that small and emerging brands comprised 40% of SKUs on shelf. The chain’s “Up and Comers” program had over 900 applicants that same year, and Foxtrot had become a destination for new brands to try their hand in food retail.

Foxtrot’s Up & Comers program offered new brands the chance to land distribution and marketing in … [+]

Lex Evan of Lexington Bakes won the Up & Comers program in 2023. “I credit Foxtrot with putting us on the map and being the reason why I even have a brand,” he shared. “They are the store that catapulted our brand to relevancy. It later led to [California-based retail store] Erewhon bringing us to their stores.”

Ashley Nickelson, the founder and CEO of BTR Nation, concurs. Her product was carried in all 33 Foxtrot locations. She said, “Foxtrot and Dom’s gave us this launch pad with their Up & Comers program. It gives brands the opportunity to get in front of a buying team. Who’s gonna step in and do that in the industry?”

Lost Revenue, Unrecovered Inventory and Outstanding Invoices

With the sudden closure of Foxtrot and Dom’s, small business owners are left with more questions than answers. Founder and CEO of Carolyn’s Crisps Amy Kessler said that the closure, “has wiped out our distribution in Chicago. My brand was represented in many Chicago neighborhoods with Foxtrot. I keep asking myself how we are going to maintain visibility in Chicago without having a consistent presence all over the city.” 65% of her company’s distribution was via Foxtrot stores. She also worries about cashflow, sharing that, “We still have outstanding invoices with Foxtrot.”

The expansion into Dom’s Market less than a month ago represented a 30% increase in revenue for Yuta … [+]

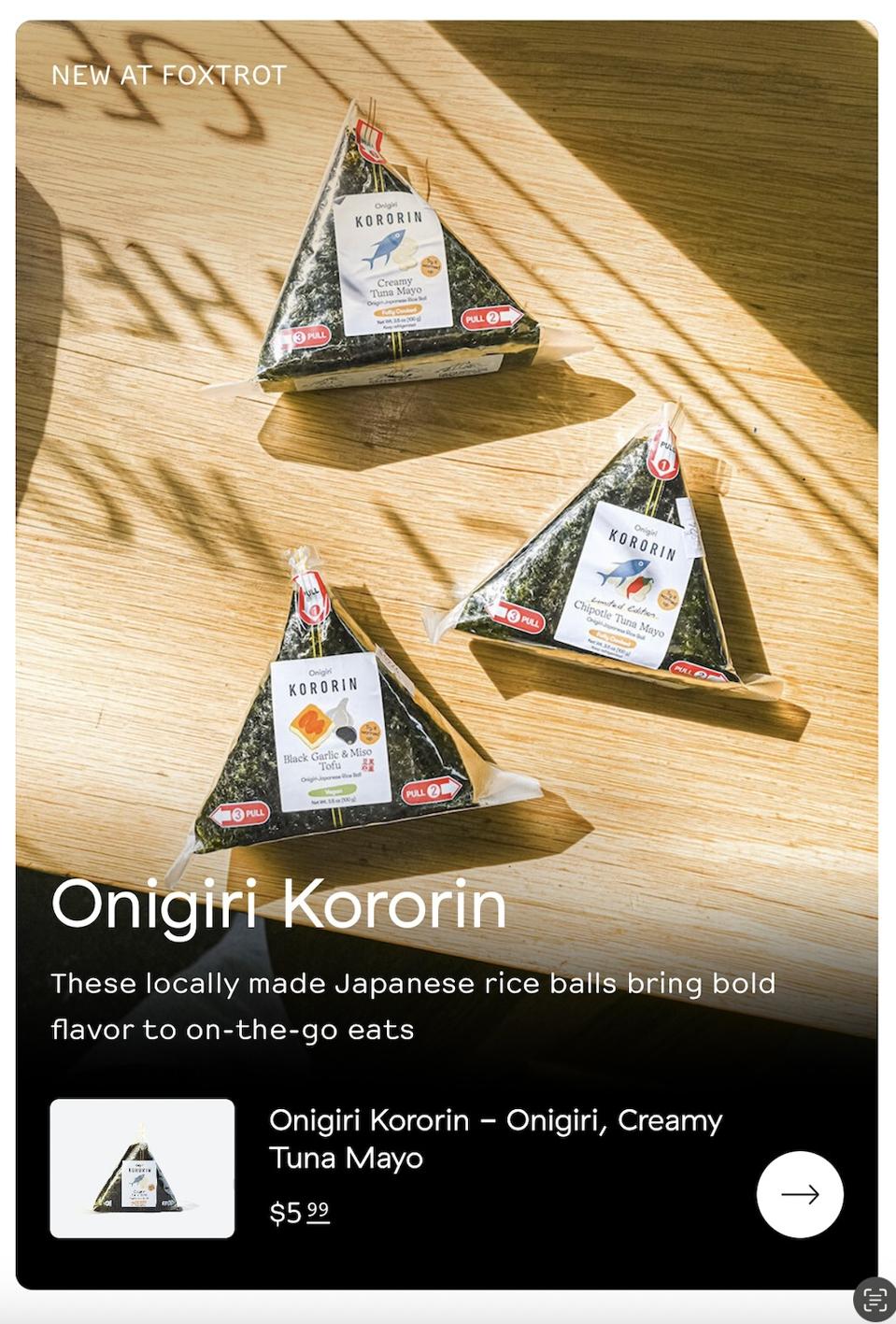

The expansion into Dom’s Market and Foxtrot stores less than a month ago represented a 30% increase in revenue for Yuta Katsuyama and Cristina Tarriba, the co-founders of Onigiri Kororin. “We had to raise some money to cover our inventory and labor to start selling in Foxtrot stores. We are kind of lucky that this happened so soon because we were about to expand our team and invest in our equipment to meet Foxtrot’s sales demand.”

Gefen Skolnick has been selling Couplet Coffee in Foxtrot for two years; customers are reaching out via social media to ask where to purchase the brand’s coffee, now they they cannot do so in stores. He said, “I’m deeply in shock that our products & several of our friends’ products were just left in the stores. I’m even more shocked that there wasn’t a grace period, communication with brands or seemingly [with distributor], Pod Foods. We now have several cases of coffee and we are worried about getting paid and about our inventory left stranded.”

Losing the Foxtrot Community

For some small business owners, the loss goes beyond capital. Many had formed relationships with Foxtrot and Dom’s employees over the years. Outfox Hospitality reported 1,000 employees in November of last year; it is unclear how many, if any, remain at the parent company.

Nemi’s snacks being sold at Dom’s Market in Chicago. The company’s abrupt closure has left many … [+]

“Dom’s was always very approachable when it came to working with local brands and supporting emerging brands. They had a reputation for that. They paid on time on from my experience,” shared Regina Trillo, co-founder of Nemi. “I’m just very concerned about the staff. I’m concerned because it was a very sudden and abrupt way of ending.”

Michael Ciapciak of Bang Bang Pie & Biscuits and Pretty Cool Ice Cream started supplying pies, baking mixes, and other products to Foxtrot in 2018. He said that he is, “owed a significant amount of money between the two companies.” Payment of outstanding invoices is uncertain. Despite the situation, Ciapciak shared, “The Foxtrot team was very flexible. The buyers and the direct contacts in the stores responsible for bringing in brands bent over backwards to accommodate smaller orders. The team on the ground wanted the best of the best in their respective stores. And they were trying to build something great.”